True, the only tech and data-first global talent platform, today released proprietary data highlighting the latest CEO hiring trend: Public and private equity-backed tech companies are hiring CEOs from the venture capital asset class nearly 3x more often than in recent years.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231018496301/en/

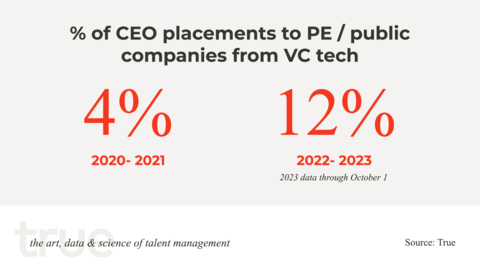

Since 2022, 170% more of True’s PE and public tech companies hired their CEOs from VC-backed companies than in 2020-2021. (Graphic: Business Wire)

Public and PE Portfolio Companies Want Venture Talent

Over the past two years, the number of CEOs coming directly from VC-backed tech companies to PE-backed or publicly traded companies has increased to 12%. This represents a significant 2.7 times growth compared to the rate observed from 2020 to 2021. Further, 64% of True’s CEO placements across all asset classes in the past three years have identified growth, innovation, and transformation as priority objectives of their role.

“The technological innovation inherent in the DNA of every great startup CEO is deeply valuable to large private and public companies undergoing digital transformation,” said Jon Mackey, True’s managing director of global public markets. “Every year we’re seeing clients demonstrate more trust in the transformative CEO talent coming from venture.”

This interest in VC talent extends beyond the CEO role. True data shows the share of its executives hired to public and PE-backed companies directly from VC tech is up 50% YoY and roughly 2x the rate observed in 2020-2021.

Pressures on Founder CEOs Prompt Turnover

Not only is VC talent more attractive to PE and public companies, but there are also a number of market-driven pressures enticing, or sometimes forcing, VC CEOs from their positions.

While True’s proprietary data shows YoY increases in CEO searches across every asset class, there is also a noticeably larger amount of hiring activity in VC-backed companies. At True, early-stage VC CEO searches are up 44% YoY, while late-stage companies are seeing a still notable 16% YoY increase.

Our VC Practice has observed some CEOs caught in the middle of differing goals from their early and late stage investors. With valuations low after the sky-high expectations of 12 to 18 months ago, some investors are seeking conflicting courses of action from their VC CEOs depending on how much they invested and when. Some VC CEOs say they’ve had enough and are ready to explore other asset classes for leadership roles or return to their roots as product visionaries.

“As True grows in our share of public company hiring, it remains true that no one knows venture talent like we do,” said Shawn Thorne, managing director of the VC practice. “We have a global reach and ability to serve PE and public clients while still maintaining core relationships with the transformational talent in tech. Many of the best innovators spend some share of time in different asset classes across their career and we have a unique ability to enable that journey,” Thorne added.

ABOUT TRUE

True is the world’s only tech and data-first talent management platform. The sixth largest in its industry, True leverages 10+ years worth of proprietary data, market insights, and talent lifecycle expertise, to help companies make high-impact talent decisions quickly. True’s unmatched products and services include True Search (retained executive search), TrueBridge (advisory, interim, and fractional executive placement), Thrive (Talent CRM software), Search Essentials (tech-enabled hiring services), AboveBoard (inclusive executive career community), and Jopwell (leading diversity tech platform for early-mid career professionals). True also backs promising companies through its investment brands True Equity and Vera Equity.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231018496301/en/