Reorg, the premier global provider of credit data, analytics, and intelligence, has released its Americas Advisor rankings for the first six months of 2024. The rankings data (also known as league tables) examines legal advisors, financial advisors and investment bankers on the basis of their involvement in the restructuring market. Reorg’s ranking report provides fresh perspectives and insights related to the costs of chapter 11 cases and advisors’ final approved earnings from those cases.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240715047926/en/

(Graphic: Business Wire)

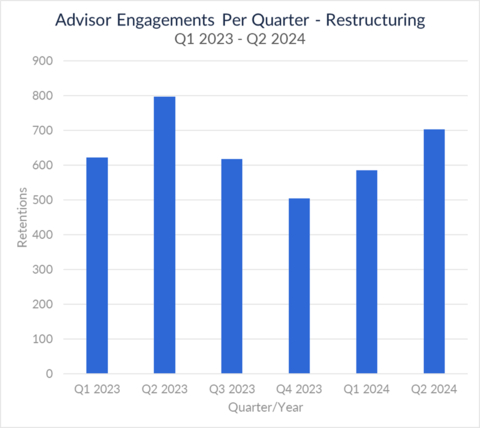

Restructuring engagements announced by law firms, financial advisors and investment bankers increased 14% in the first half of 2024, compared to the second half of 2023. Activity in the second quarter of 2024 increased by 17% from the first quarter.

Kirkland & Ellis led in restructuring legal engagements in the first half, followed by Gibson Dunn and Akin Gump. AlixPartners led for financial advisors, followed by FTI and Alvarez & Marsal. PJT led for investment bankers, followed by Houlihan Lokey and Evercore.

The busiest sector for advisory engagements in the first half of 2024 was consumer discretionary, which accounted for 20% of total engagements, followed by healthcare and industrials with 18% each.

Reorg’s Americas Advisor League Tables for the first six months of 2024 also rank advisors by total fees approved by chapter 11 bankruptcy courts during the period, which totaled $757 million for law firms, financial advisors and investment bankers across 63 chapter 11 cases.

- Weil led law firms with $60.1 million, followed by Kirkland & Ellis with $44.7 million and Latham with $32.6 million.

- For financial advisors, Alvarez & Marsal led with $31 million in fees, followed by AlixPartners with $12 million and Province with $11 million.

- On the investment banker side, PJT led with $90.2 million in fees, followed by Guggenheim with $34.9 million and Lazard with $18.5 million.

Access the Americas Restructuring Advisor Rankings report on Reorg’s website.

About Reorg

Founded in 2013, Reorg is the essential credit intelligence and data asset for the world’s leading investment banks, asset managers and hedge funds, law firms and professional services advisory firms. By surrounding unparalleled human expertise with proven technology, data and AI tools, Reorg unlocks powerful truths that fuel decisive action across financial markets. Visit reorg.com to learn how we deliver rigorously verified intelligence at speed and create a complete picture for professionals across the entire credit lifecycle. Stay current with Reorg on LinkedIn.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240715047926/en/