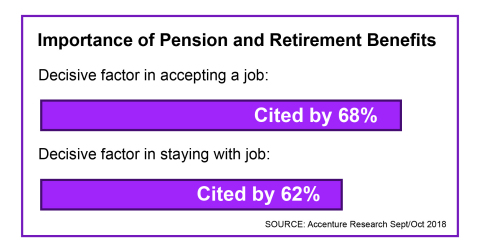

Pension or retirement benefits are a critical factor for most workers when deciding whether to accept a job or deciding whether to stay with their current employer, according to research from Accenture (NYSE: ACN) covering 10 countries in Europe, Asia-Pacific and South America.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190711005002/en/

(Graphic: Business Wire)

Specifically, the research found that two-thirds (68%) of workers with pension or retirement plans said those benefits were a critical factor in deciding whether or not to accept a job, and 62% said they were a critical factor in staying with a job.

The research also found strong interest among workers for more help in planning for their retirement, and strong interest — but limited current use — of digital channels for pensions and retirement information and planning.

For instance, nearly six in seven workers (84%) said they want more help with pension and retirement planning, and more than five in six (82%) said they want help with coaching. Younger workers are the most interested, with 87% of millennials citing an interest in planning and 84% wanting retirement coaching.

In contrast to the strong interest in planning assistance, less than half (41%) of currently active employees said their employer offers such education or coaching. Slightly more (43%) said their employer does not offer it, and 16% were uncertain if their employer offers such services.

“People around the world are increasingly using digital services to make their lives easier and more productive,” said Owen Davies, who leads Accenture’s global pension practice. “Employers should ensure that their pension and retirement organizations find ways to close the gap between the ‘digital life’ that their members seek and what is currently available. As part of that, they should focus on enhanced planning and education for workers.”

Underserved Demand for Digital Channels

The survey found a strong but generally underserved interest in the use of digital communication channels for pension and retirement information. For instance, interactive web pages were the most popular channel to receive such information, cited by 57% of respondents, yet only 23% said they have actually used interactive web pages for that purpose.

Similarly, more than half (53%) of respondents said they’re interested in using a mobile app to receive such information, but only 18% have done so. Almost half (47%) of respondents said they would like to use a digital pensions or retirement coach, but only 12% have done so. Perhaps not surprising, interest in digital channels is especially strong among millennial workers.

“We see some significant differences between countries, arising from differences in legislation, availability of digital services and the maturity of the modernization programs of pension and retirement organizations,” said Bjørn Tore Holte, Accenture’s pension industry lead in Europe. “But we also see similarities in strong demand for better services and more information on pensions and retirement options and planning.”

Implications for Employers, Pension Providers and Employees

As a result of the findings, Accenture makes several recommendations for employers and the pension and retirement organizations that serve their employees:

- Acknowledge the Importance of Pension and Retirement Benefits – Employers should ensure that their HR strategies acknowledge that pension and retirement considerations are critically important to job seekers and current employees and ensure that they address employees’ strong appetites for retirement information and support.

- Build Awareness of Benefits – With many workers uncertain whether their employer offers pension and retirement planning, and 43% believing their employer does not, there is clearly a large awareness gap to be closed. As workers age, their concerns regarding the security of their retirement increase; from a workforce stability and productivity standpoint, it’s important for employers ensure their providers address this with employees and retirees.

- Leverage Digital Channels – Although few workers currently use digital communication channels for information and support on pension benefits and retirement planning, demand is high. As such channels are increasingly pervasive in other areas of work and life, employers should ensure their pension and retirement organizations bolster their digital offerings to meet the demand from potential recruits and current workers.

“Over the past decade people have shown an incredible appetite for services and convenience through digital, and this includes information and services related to pensions and retirement,” Davies said. “Pensions and retirement benefits are critically important to workers, yet they generally want more information and help, and the research shows ways to address that.”

About the Research

Accenture surveyed 5,000 workers with pension plans across 10 countries — Australia, Brazil, Finland, France, Germany, Italy, Japan, Norway, Singapore and the United Kingdom — with 500 respondents from each country. Respondents were evenly split between the private and public sectors. The online survey was conducted during September and October 2018.

About Accenture

Accenture is a leading global professional services company, providing a broad range of services and solutions in strategy, consulting, digital, technology and operations. Combining unmatched experience and specialized skills across more than 40 industries and all business functions — underpinned by the world’s largest delivery network — Accenture works at the intersection of business and technology to help clients improve their performance and create sustainable value for their stakeholders. With 482,000 people serving clients in more than 120 countries, Accenture drives innovation to improve the way the world works and lives. Visit us at www.accenture.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190711005002/en/