CoreLogic® (NYSE: CLGX), a leading global property

information, analytics and data-enabled solutions provider, today

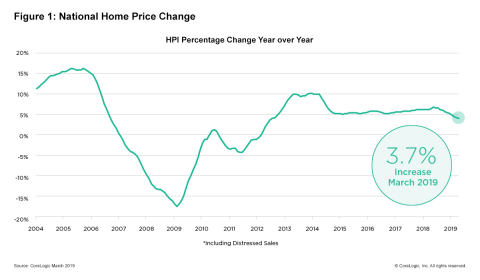

released the CoreLogic Home Price Index (HPI™) and HPI

Forecast™ for March 2019, which shows home prices rose both

year over year and month over month. Home prices increased nationally by

3.7% year over year from March 2018. On a month-over-month basis, prices

increased by 1% in March 2019. (February

2019 data was revised. Revisions with public records data are

standard, and to ensure accuracy, CoreLogic incorporates the newly

released public data to provide updated results each month.)

This press release features multimedia. View the full release here:

https://www.businesswire.com/news/home/20190507005220/en/

CoreLogic National Home Price Change; March 2019. (Graphic: Business Wire)

Looking ahead, after some initial moderation in early 2019, the

CoreLogic HPI Forecast indicates home prices will begin to pick up and

increase by 4.8% on a year-over-year basis from March 2019 to March

2020. On a month-over-month basis, home prices are expected to decrease

by 0.3% from March 2019 to April 2019. The CoreLogic HPI Forecast is a

projection of home prices calculated using the CoreLogic HPI and other

economic variables. Values are derived from state-level forecasts by

weighting indices according to the number of owner-occupied households

for each state.

“The U.S. housing market continues to cool, primarily due to some of our

priciest markets moving into frigid waters,” said Dr. Ralph McLaughlin,

deputy chief economist at CoreLogic. “But the broader market looks more

temperate as supply and demand come into balance. With mortgage rates

flat and inventory picking up, we expect more buyers to take advantage

of easing housing market headwinds.”

According to the CoreLogic Market Condition Indicators (MCI), an

analysis of housing values in the country’s 100 largest metropolitan

areas based on housing stock, 35% of metropolitan areas have an

overvalued housing market as of March 2019. The MCI analysis categorizes

home prices in individual markets as undervalued, at value or

overvalued, by comparing home prices to their long-run, sustainable

levels, which are supported by local market fundamentals (such as

disposable income). Additionally, as of March 2019, 26% of the top 100

metropolitan areas were undervalued, and 39% were at value.

When looking at only the top 50 markets based on housing stock, 40% were

overvalued, 16% were undervalued and 44% were at value in March 2019.

The MCI analysis defines an overvalued housing market as one in which

home prices are at least 10% above the long-term, sustainable level. An

undervalued housing market is one in which home prices are at least 10%

below the sustainable level.

During the first quarter of 2019, CoreLogic together with RTi Research

of Norwalk, Connecticut, conducted an extensive survey measuring

consumer-housing sentiment in high-priced markets. The survey

respondents indicated high home prices have an impact on high rental

prices as well. Nearly 76% of renters and buyers in high-priced markets

agreed housing prices in these markets appeared to be driving rental

rates up.

“The cost of either buying or renting in expensive markets puts a

significant strain on most consumers,” said Frank Martell, president and

CEO of CoreLogic. “Nearly half of survey respondents – 44% of renters –

cited the cost to rent in high-priced housing markets as the number one

barrier to entry into homeownership. This is potentially forcing renters

to wait longer to have the necessary down payment in these communities.”

The next CoreLogic HPI press release, featuring April 2019 data, will be

issued on Tuesday, June 4, 2019 at 8:00 a.m. ET.

Methodology

The CoreLogic HPI™ is built on

industry-leading public record, servicing and securities real-estate

databases and incorporates more than 40 years of repeat-sales

transactions for analyzing home price trends. Generally released on the

first Tuesday of each month with an average five-week lag, the CoreLogic

HPI is designed to provide an early indication of home price trends by

market segment and for the “Single-Family Combined” tier, representing

the most comprehensive set of properties, including all sales for

single-family attached and single-family detached properties. The

indices are fully revised with each release and employ techniques to

signal turning points sooner. The CoreLogic HPI provides measures for

multiple market segments, referred to as tiers, based on property type,

price, time between sales, loan type (conforming vs. non-conforming) and

distressed sales. Broad national coverage is available from the national

level down to ZIP Code, including non-disclosure states.

CoreLogic HPI Forecasts™ are

based on a two-stage, error-correction econometric model that combines

the equilibrium home price—as a function of real disposable income per

capita—with short-run fluctuations caused by market momentum,

mean-reversion, and exogenous economic shocks like changes in the

unemployment rate. With a 30-year forecast horizon, CoreLogic HPI

Forecasts project CoreLogic HPI levels for two tiers — “Single-Family

Combined” (both attached and detached) and “Single-Family Combined

Excluding Distressed Sales.” As a companion to the CoreLogic HPI

Forecasts, Stress-Testing Scenarios align with Comprehensive Capital

Analysis and Review (CCAR) national scenarios to project five years of

home prices under baseline, adverse and severely adverse scenarios at

state, Core Based Statistical Area (CBSA) and ZIP Code levels. The

forecast accuracy represents a 95% statistical confidence interval with

a +/- 2% margin of error for the index.

About the CoreLogic Consumer Housing Sentiment Study

In the first quarter of 2019, 1,002 renters and homeowners were surveyed

by CoreLogic together with RTi Research. This study is a quarterly pulse

of U.S. housing market dynamics. Each quarter, the research focuses on a

different issue related to current housing topics. This first quarterly

study concentrated on consumer sentiment within high-priced markets. The

survey has a sampling error of +/- 3.1% at the total respondent level

with a 95% confidence level.

About RTi Research

RTi Research is an innovative, global market research and brand strategy

consultancy headquartered in Norwalk, CT. Founded in 1979, RTi has been

consistently recognized by the American Marketing Association as one of

the top 50 U.S. insights companies. The company serves a broad base of

leading firms in Financial Services, Consumer Goods, and Pharmaceuticals

as well as partnering with leading academic centers of excellence.

Source: CoreLogic

The data provided are for use only by the primary recipient or the

primary recipient’s publication or broadcast. This data may not be

resold, republished or licensed to any other source, including

publications and sources owned by the primary recipient’s parent company

without prior written permission from CoreLogic. Any CoreLogic data used

for publication or broadcast, in whole or in part, must be sourced as

coming from CoreLogic, a data and analytics company. For use with

broadcast or web content, the citation must directly accompany first

reference of the data. If the data are illustrated with maps, charts,

graphs or other visual elements, the CoreLogic logo must be included on

screen or website. For questions, analysis or interpretation of the

data, contact Alyson Austin at newsmedia@corelogic.com

or Allyse Sanchez at corelogic@ink-co.com.

Data provided may not be modified without the prior written permission

of CoreLogic. Do not use the data in any unlawful manner. The data are

compiled from public records, contributory databases and proprietary

analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and

solutions, promotes a healthy housing market and thriving communities.

Through its enhanced property data solutions, services and technologies,

CoreLogic enables realtors, financial institutions, insurance carriers,

government agencies and other housing market participants to help

millions of people find, acquire and protect their homes. For more

information, please visit www.corelogic.com.

CORELOGIC, the CoreLogic logo, CoreLogic HPI and CoreLogic HPI

Forecast are trademarks of CoreLogic, Inc. and/or its subsidiaries. All

other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20190507005220/en/