Balance, Canada’s largest digital asset custodian, today unveiled Balance Yield, a turnkey solution which enables clients to participate in yield generation workflows such as staking, delegating, or pledging assets through third-party partners of their choice.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220907006158/en/

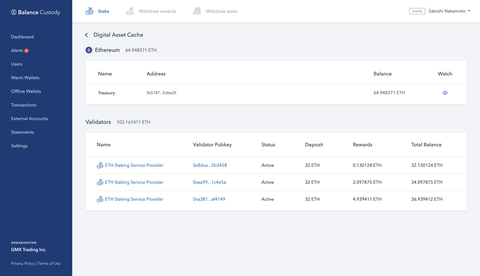

Ethereum (ETH) staking UX on the Balance Custody web platform. (Graphic: Business Wire)

Balance Yield has been running in closed pilot mode since May 2021 with a select set of clients. Today’s announcement opens the door to all Balance Custody clients to perform the following from either offline or warm wallets:

- Stake Ethereum (ETH) through a staking services provider of their choice such as Attestant, Figment, or Coinbase.

- Delegate, undelegate, redelegate, and withdraw network rewards on blockchains with a delegated proof-of-stake (DPoS) consensus model.

- Pledge Filecoin (FIL) to on-chain storage providers and earn network rewards.

- Generate regulatory compliant Maximal Extractable Value (MEV). Balance’s proprietary relay ensures the blocks the staking partner proposes are compliant with OFAC and similar sanctions programs and do not frontrun or sandwich transactions to extract MEV.

- Retain the full ownership and control of your assets and rewards through the entire yield workflow.

In its role as a custodian, Balance does not provide any staking, validation, or on-chain storage services itself. Each client onboards directly with the yield provider and, as required, authorizes Balance to pass instructions to them on the client’s behalf.

“Our pilot clients have generated yield on over $500M worth of assets in the last 15 months, demonstrating the robustness of our approach. With MEV generation as the latest addition, the product offering is now complete. We’re beyond excited to be able to offer this at large, just in time for Ethereum’s transition to proof-of-stake consensus.” – Nuno Silva, Chief Product Officer

“Whereas most yield workflows involve relinquishing assets ownership and taking counterparty risk, we took the harder road and did the work to enable clients to maintain full ownership and control throughout the entire yield lifecycle. This dramatically reduces risk, without incurring additional costs. We’re here to help clients generate yield, not take a cut of it.” – George Bordianu, Chief Executive Officer

Balance currently serves crypto exchanges, OTC and proprietary trading desks, ATM networks, private funds, market makers, liquidity providers, and corporate entities and foundations. To find out more, visit www.balance.ca/yield.

Disclaimer

PARADISO VENTURES INC. O/A Balance is a private company incorporated under the laws of the Canada Business Corporations Act, R.S.C., 1985, c. C-44, with its registered office address at 325 Front St W, 4th floor (Attn: Balance), M5V 2Y1, Toronto, Ontario, Canada which sells digital goods and services. This is not an offer or solicitation of any investment contract or financial security and should not be misconstrued as such. Digital assets and the blockchain are early technologies and as such have an associated high degree of risk. Balance does not provide financial, investment, tax, legal, or any other type of professional advice. For informational purposes only.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220907006158/en/