VantageScore Solutions, LLC, the developer of the VantageScore credit score model, announced today a free and transparent resource that provides key consumer credit score metrics and insights at https://vantagescore.com/consumer-credit-score-insights.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210525005623/en/

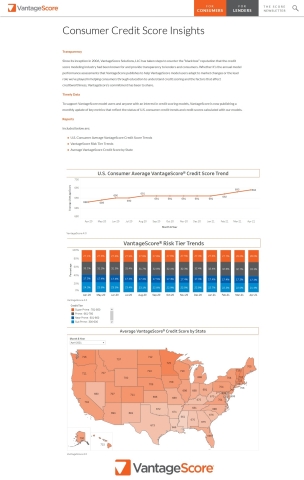

VantageScore launches a free and transparent resource that provides key consumer credit score metrics and insights at https://vantagescore.com/consumer-credit-score-insights. The VantageScore Consumer Credit Score Insights is updated monthly. It also is interactive and searchable by month and can be easily downloaded. (Graphic: Business Wire)

These important metrics shed light on how consumers are managing their credit health, both nationally and locally, as the COVID-19 pandemic winds down and the economy shifts.

Launched with the most recent April 2021 data, VantageScore will provide monthly updates on the following consumer credit score-related metrics and insights, including:

- National average VantageScore credit score, updated monthly and dating back to January 2020

- VantageScore Risk Tier Insights (i.e., the percentage of the population that fall within the Super Prime, Prime, Near Prime and Sub-Prime segments)

- A heat map of the United States that includes each state’s average VantageScore credit score

LATEST INSIGHTS

As of April 2021, the national average VantageScore credit score was at 694, which has steadily risen from 688, the average for the same time a year ago. Similarly, the percentage of consumers in the Sub-Prime category has decreased while the percentage of consumers in the Super Prime category has increased steadily within that time period.

“Based on these national averages, consumers, by and large, have been managing their credit health in a positive way, likely supported by government stimulus checks and facilitated by the stay-at-home orders that cut down on travel and leisure expenditures. At the same time, many consumers are still significantly impacted by COVID-19 and have sustained significant financial burdens despite the government’s recovery efforts. By looking at this information geographically, we can better assess the areas where consumers are suffering more financial stress,” said Dr. Emre Sahingur, senior vice president of research, predictive analytics and product management at VantageScore Solutions.

The VantageScore Consumer Credit Score Insights will be updated each month. Updates will be announced via social media, and a quarterly written review will be posted on the VantageScore website as well as distributed to subscribers of THE SCORE, VantageScore’s popular monthly e-Newsletter. The data is interactive and searchable by month and can be easily downloaded.

“We are closely monitoring these trends and the underlying credit behaviors that impact credit scores to make sure our credit scoring models continue to remain highly predictive. We also strongly encourage lenders to closely examine their models and proactively perform model governance exercises, including periodic validations, to ensure continued safe and sound lending practices,” noted Dr. Sahingur.

The availability of this information for consumers, policymakers, lenders and other interested market participants is another component of VantageScore’s long and intentional focus on transparency in the credit scoring arena.

In addition to these newly available metrics, VantageScore has always made publicly accessible its annual model performance assessment, a database of reason codes (alongside deeper, easy-to-understand explanations of those codes and tips for consumers), as well as a wealth of information and documentation for consumers and users of VantageScore credit scores.

There is also a robust library of other consumer education materials and deep analysis of the VantageScore models available on www.vantagescore.com, which was recently rebuilt and redesigned for easy navigation and sharing.

“Whether you are a consumer or a user of credit score models, you need to feel informed and empowered to make the right decisions,” said Dr. Sahingur. “We are very pleased to offer this helpful information and will continue to set the bar high for transparency, educational outreach, model performance and governance.”

ABOUT VANTAGESCORE SOLUTIONS

VantageScore Solutions, initially developed by America’s three national credit reporting companies (CRCs) – Equifax, Experian, and TransUnion, is the independently managed company behind the VantageScore credit scoring model.

VantageScore credit scores are used by lenders, landlords, utility companies, telecom companies, and many others to determine creditworthiness. While there are many credit scoring models, the “win-win” for VantageScore is its innovative, highly predictive, patent-protected, tri-bureau scoring methodology that scores 40 million more people than legacy models – without lowering risk standards – and provides lenders and consumers with more consistent credit scores across all three national CRCs. A recent study found that approximately 12.3 billion VantageScore credit scores were used from July 2018 to June 2019 by over 2,500 unique users, including 2,200 financial institutions and 9 of the top 10 largest banks.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210525005623/en/