Insolvencies Fell In 2012 But IT Stands Out As A Very Risky Business

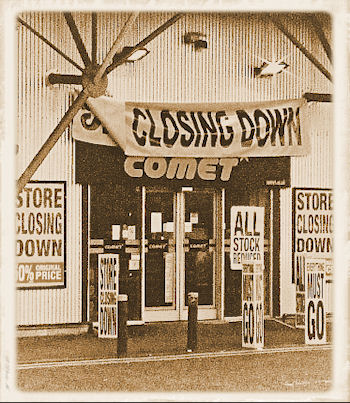

IT firms are suffering in an improving business climate where 2012 insolvencies hit their lowest rate since 2007

The number of companies going bust in the UK is decreasing, according to an Experian business survey. But,out of the five largest industry sectors in the UK, the IT industry saw the number of firms going out of business in 2012 increase by a massive 21.66 percent to 837 firms.

According to Experian’s latest Business Insolvency Index, the UK average for insolvencies had fallen 0.86 percent from the previous year, to 20,889 businesses. The year ended with December seeing 0.08 percent of businesses fail. This compares to 0.11 percent in the same month during 2011 and represents the lowest rate seen in December since 2007.

Better outlook

The greatest improvement in insolvency risk was seen by firms with 51-100 employees where the rate fell from 2.22 percent in 2011 to 1.83 percent in 2012. This was followed closely by firms with 26-50 employees, where insolvencies fell to 2.21 percent from 2.59 percent in 2011, and firms with 11-25 employees, where the rate dropped from 2.60 percent in 2011 to 2.35 percent.

Significant year-on-year increases in the rate of insolvencies mainly involved the largest firms, those with over 500 employees, which saw an increase from 1.46 percent in 2011 to 1.61 percent in 2012. In addition, micro-firms with only one or two employees saw a slight increase from 0.71 per cent to 0.73 per cent.

Max Firth, managing director at Experian Business Information Services, said, “Following the slight upturn in 2011, 2012 has seen the business insolvency rate fall and then remain stable throughout the year. In particular, firms that suffered most during the downturn were the ones to see the most significant improvements.

“The rate of insolvencies is significantly lower now than when it was at its peak in 2009 at 1.25 per cent, but there is still a way to go before we reach the pre-recession rate of 2007, which stood at 0.97 per cent,” he affirmed.

Firth added that companies would “need to remain prudent in order to prosper. By sharing data with credit reference agencies, businesses can improve their own credit rating, which should also be regularly monitored to ensure businesses are in the best position to secure deals and finance as required”.