Economic Fears Cause IT Service Contracts to Plummet In Value

Lowest figures for nine years cast a shadow over the New Year as corporate belts tighten, according to an Ovum report

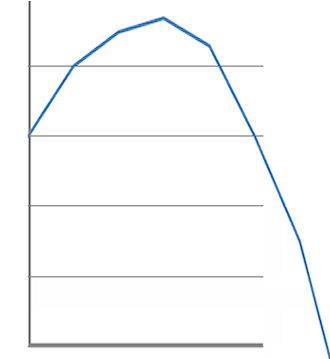

The market for IT services has seen total contract value plummet to a nine year low and belts continue to be tightened in both the public and private sector.

According to analyst firm Ovum, total contract value (TCV) dropped by a third in the third quarter of this year, its lowest level in nine years. The number of private sector contracts reached an 11 year low, with public sector TCV and deal volume at their lowest levels in three years.

In the company’s latest analysis of IT services contracts activity, it revealed that the TCV of IT services deals announced in the three months ending September 2012 was $18.9 billion (£11.7 bn), down 33 per cent on the same period last year.

Double-dip regression

The volume of deals fell sharply, to 332 from 438 in the third quarter of last year. This, said Ovum, was the least activity in a single three-month period in nearly five years, since just 324 contracts were tracked during the fourth quarter of 2007.

“The signs of recovery in the IT services market apparent in the second quarter of 2012 were largely conspicuous by their absence in the third quarter of 2012,” explained Ed Thomas, senior analyst at Ovum.

“There will need to be a significant upturn in both TCV and deal volume if last year’s performance is to be matched in 2012. On current form, both annual TCV and the number of deals are set to hit 10 year lows, as the global economic crisis continues to impact the performance of the IT services industry.”

Europe provided the bulk of the few private sector contract deals that were signed in the third quarter of 2012, while activity plunged suddenly in North America, a market on which many IT services vendors depend. Overall private sector TCV was given a boost by two mega-deals (contracts valued at $1 billion or more) announced by CSC and IBM, however the quarterly return of $8.3 billion (£5.1bn) was still the lowest since the second quarter of 2011 ($7.1 billion – £4.4 billion).

For the public sector, TCV in the third quarter of 2012 was $10.6 billion (£6.5bn), down 43 per cent on the same period of the previous year, while the number of deals tracked by Ovum fell 22 per cent to 195, with no mega-deals. Largely as a result of the lack of large projects, the average value of public sector contracts slipped to $54.6 million (£33.9m), almost half the average public sector award in the second quarter of 2012.

“This sharp dip in activity will wipe out any optimism engendered in the previous quarter, when an increase in the number of deals brought to an end seven consecutive quarters of decline,” said Thomas.