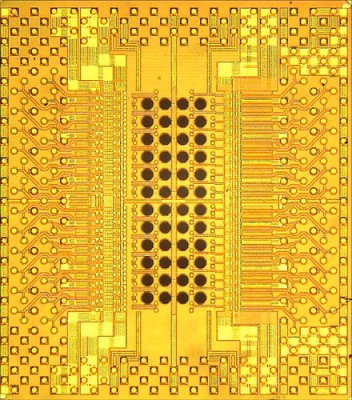

IDC: x86 server chips see strongest growth in 2011

PC chip revenues worldwide grew to $10.9 billion (£6.3 billion) in the fourth quarter of 2011, with the server segment showing the most substantial growth, according to market research company IDC.

The fourth-quarter figures were up 1.8 percent on the third quarter of 2011 and were 14.2 percent up on the fourth quarter of 2010, IDC said. Full-year revenues were up 13.2 percent to more than $41 billion, boosted in part by a substantial rise in processor average selling prices (ASPs).

ASP growth

“The ASP that OEMs pay for PC microprocessors rose more than nine percent in 2011, making 2011 the second consecutive year of notable ASP increases,” said Shane Rau, director of semiconductors: personal computing research at IDC, in a statement.

Overall shipments were up 3.6 percent for 2011 over 2010, with the largest growth seen in X86 server chips. Mobile PC processor shipments were up 3.9 percent in 2011 over 2010 while desktop processor shipments grew 2.7 percent.

Intel led the pack overall with 80.3 percent of the worldwide processor market in the fourth quarter, up 0.1 percent on the third quarter, while AMD held 19.6 percent, down 0.1 percent and Taiwanese contendor Via Technologies controlled 0.1 percent of the market, even with the third quarter.

In mobile PC processors, Intel held 82.3 percent in the fourth quarter, while AMD ended the quarter with 17.6 percent. For the full year, Intel held 83.8 percent of this segment, down 2.6 percent over 2010, while AMD ended up with 16 percent, up 2.7 percent, and Via held 0.2 percent, down 0.1 percent.

New mobile chips

AMD’s performance in mobile PC processors was aided by its Fusion accelerated processing units (APUs), which it launched in January 2011 and pushed energetically throughout the year. Intel fought back with its Sandy Bridge architecture, which also features integrated graphics.

Intel held 94.3 percent of the PC server/workstation processor segment for the fourth quarter, down 0.8 percent from the previous quarter, while AMD held 5.7 percent, up 0.8 percent. For the full year, Intel finished with 94.5 percent of this segment, up 1.5 percent from 2010, while AMD held 5.5 percent, down 1.5 percent.

Both Intel and AMD saw delayed server chip launches during 2011, Intel with its Xeon E5 processors and AMD with its Opteron 6200 Interlagos chips, which arrived in November 2011.

In desktop PC processors, Intel gained 0.3 percent to hold onto 76.1 percent of the market, while AMD lost 0.3 percent to end at 23.8 percent. For the full year Intel held 73.8 percent, up 1.7 percent on 2010, while AMD held 26 percent, down 1.6 percent, and Via held 0.2 percent, down 0.2 percent.

Hard disk shortages resolved

IDC expects the PC chip market to grow 5.1 percent in 2012, predicting that the hard-disk shortages that hindered PC purchases last year, in the wake of floods across Thailand, have now been resolved.

“IDC now believes that the HDD shortage will not be a significant factor in PC shipments in 2Q12,” IDC said.

The company also said that stabilising sovereign debt issues in Europe and improving job growth in the US may allow it to “modestly” raise its projected growth rate at the close of the first quarter of 2012.

Recent Posts

Flashpoint enters new chapter with global partner programme

Security vendor Flashpoint debuts partner programme following $28m funding

Channel partner “disconnect” hindering growth

Complex buying journeys and sprawling partner networks hampering customer experience, says Accenture

Cyxtera launches global channel partner programme

Datacentre provider Cyxtera says launch is “milestone in our go-to-market strategy”

US IT provider brings mainframe services to UK

Ensono highlights importance of mainframes still to major industries

VASCO and Nuvias expand distribution across EMEA

Security vendor VASCO looks to replicate UK and German set up across EMEA

Splunk says channel investments driving growth

Splunk details investment in Partner+ programme at .conf2017